NEUTRO ROBERTS SAPONE LIQUIDO NUTRIENTE CON OLIO DI MANDORLA DISPENSER 200 ML CON AZIONE IGIENIZZANTE - PiùMe

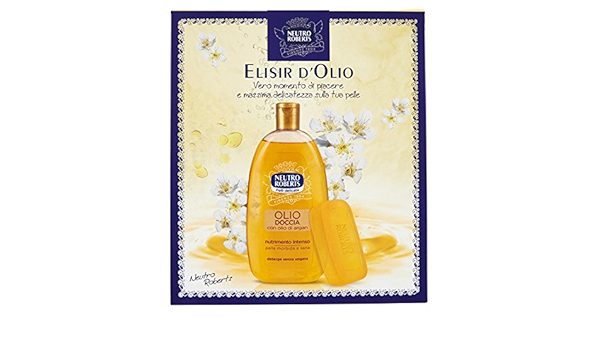

Neutro Roberts Olio Doccia con Olio d'Argan, ottimo per Pelli Delicate, Formula Nutriente e Idratante per una Pelle Morbida e Sana, Deterge Senza Ungere, Flacone da 250 ml : Amazon.it: Bellezza